by Roger Crandlemire | Mar 20, 2017 | Financial Planning, Financial Services

Most financial institutions still make it their goal to create a financial plan for their clients. This is a one-dimensional approach that falls short of the complex realities facing retirees. The goal of a financial advisor should be to clarify a client’s wants...

by Roger Crandlemire | Nov 23, 2016 | Financial Planning, Retirement Income

This week the loonie fell below 69 cents US for the first time in 13 years. There are some benefits to a low dollar, but this has a big negative effect on snowbirds. Canadians taking their usual winter escape will be feeling the pinch. Their discretionary spending, on...

by Roger Crandlemire | Jun 10, 2016 | Financial Planning, GICs, Retirement Income, Segregated Funds

Government clawbacks can potentially be applied to even modest income levels and can be an emotional matter. They can reduce both income benefits/supplements and otherwise claimable tax credits. The term used rather than ‘clawback’ by Service Canada is ‘Recovery Tax’....

by Roger Crandlemire | Apr 10, 2016 | Financial Planning, Uncategorized

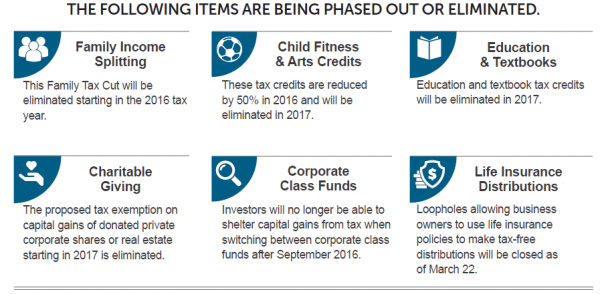

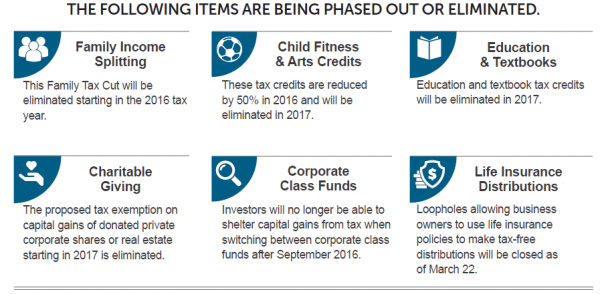

The new Liberal government announced significant changes in their budget on March 22, 2016 that affect your personal finances. Here are a few key points. Sources: Budget highlights: www.budget.gc.ca Crude oil prices:...

by Roger Crandlemire | Mar 17, 2016 | Financial Planning, Legacy Protection

Allan & Mary, Alexandria, Ontario Both in their late 60s, retired couple Allan and Mary were intent on protecting the legacy they had planned to leave for their four children. Concerned with the tax liability attached to substantial registered savings and...