Welcome to OAM Blog

Retirement | Investment | Insurance | Financial PlanningTips for Choosing the Best Travel Insurance for Canadians

Purchasing travel insurance when we leave Canada is a no-brainer. It’s paying a small amount to avoid incurring bills in the thousands and even millions. However, it is an extra expense. The cost for the baby boomer demographic is rising, and can become prohibitive if...

Deposit Brokers Earn You Higher Interest on Guaranteed Investment Certificates

The role of the middleman is to save you money. This is the case when it comes to purchasing a GIC. You receive a higher interest rate when you purchase through a deposit broker instead of going directly to the bank. Deposit brokers offer a similar type of service as...

Financial Plan or Financial Model?

Most financial institutions still make it their goal to create a financial plan for their clients. This is a one-dimensional approach that falls short of the complex realities facing retirees. The goal of a financial advisor should be to clarify a client's wants and...

Advantages of TFSAs

Many Canadians are better off contributing to a TFSA rather than an RRSP. The amount you can contribute to a TFSA is based on your TFSA contribution room. If the TFSA has not yet been opened, then the individual can contribute up to $46,500 based on the maximum...

Effects of the Low Canadian Dollar

This week the loonie fell below 69 cents US for the first time in 13 years. There are some benefits to a low dollar, but this has a big negative effect on snowbirds. Canadians taking their usual winter escape will be feeling the pinch. Their discretionary spending, on...

Charitable Gifting through Life Insurance

Are you thinking of donating a lump sum to a charity of your choice at your decease? The most efficient way to do that is through a life insurance policy, providing of course, that you are insurable. There are three methods by which a donor can gift life insurance to...

Government Clawbacks

Government clawbacks can potentially be applied to even modest income levels and can be an emotional matter. They can reduce both income benefits/supplements and otherwise claimable tax credits. The term used rather than ‘clawback’ by Service Canada is ‘Recovery Tax’....

Probate Fees

Since June of 1992 when Ontario tripled its probate fees, people have been looking for ways to avoid paying probate. Probate fees in Ontario are $250 for the first $50,000 of the estate and $15 for each additional $1000 WITH NO UPPER LIMIT. Here are some tips to...

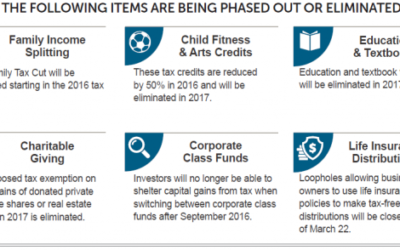

Canada’s 2016 Budget Reflections & Highlights

The new Liberal government announced significant changes in their budget on March 22, 2016 that affect your personal finances. Here are a few key points. Sources: Budget highlights: www.budget.gc.ca Crude oil prices:...

Legacy Protection 1

Allan & Mary, Alexandria, Ontario Both in their late 60s, retired couple Allan and Mary were intent on protecting the legacy they had planned to leave for their four children. Concerned with the tax liability attached to substantial registered savings and...

2015 Federal Budget Highlights for Seniors

Several of the proposals in April’s Federal Budget spell “GOOD NEWS” for seniors. Here is a summary of the high points: Registered Retirement Income Funds – Reduction in Minimum Withdrawal Factors Applicable to 2015 and subsequent taxation years Pre-age 71 rates are...